-

Philippines’ Globe Mobile Network Promos

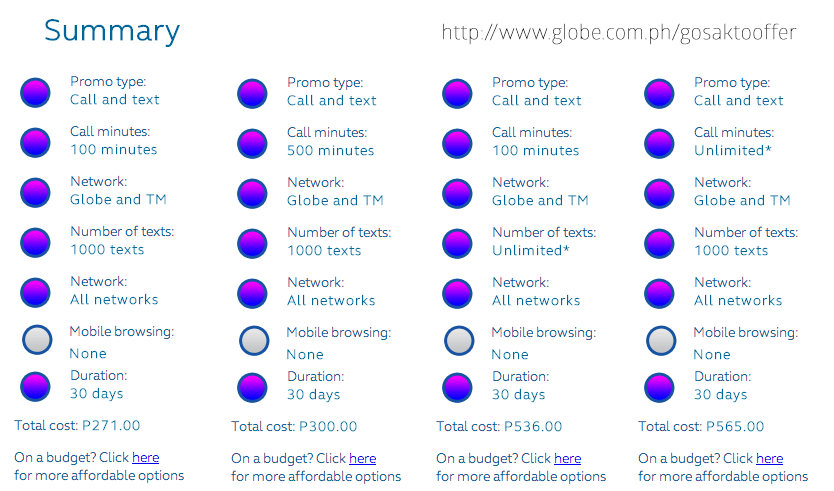

Bare necessities. If you are ever in Manila/PHL and looking to get a Prepaid mobile line for emergency and/or to just communicate around the islands, this might get you on the right track. I did some research with Globe and their “GoSakto” make-your-own combos; ~P500/month for some calls and unlimited texting ain’t bad (P300 only…

-

Financial Fitness

Aaron Patzer of Mint.com states the “4 good habits that can make the difference between going broke or building up your net worth each month”: Save money Avoid debt Invest Don’t lose it Though only 4, it takes a while to be in the practice of starting them. Upholding them is a different story. To…

-

When Will I Get My Economic Stimulus Payment?

We’ve all been asking/telling ourselves: “damn, I can use some extra cash right about now.” Well, your prayers and requests have been answered as the Government will soon be sending some dough your way: A. The Treasury Department will make payments starting in early May. Early filers, especially those who choose direct deposit, will get…

-

Keep the Change, Bank of America Says

I finally came to stumble upon this myself. Anyways… if you haven’t heard or seen yet (especially for BofA members), Keep the Change, the new program developed by Bank of America lets you save money in a weird way. From what I read, it’s pretty much a way for them to get you to keep…

-

Money-matters

While talking about ING Direct’s increased interest rate (i.e. 3.3% from 3.0%): me (10:43:26 PM): didn’t you want my financial advisor’s contact info? juan (10:44:38 PM): im good for now, i want to start saving some money before investing me (10:45:02 PM): ummm thats an oxymoron